rongweiwang Plastik 360 Derece Açı Ölçer Cetvel 360 Derece Açı Bulucu Salıncak Kol Okul Ofis Açı Cetveli Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

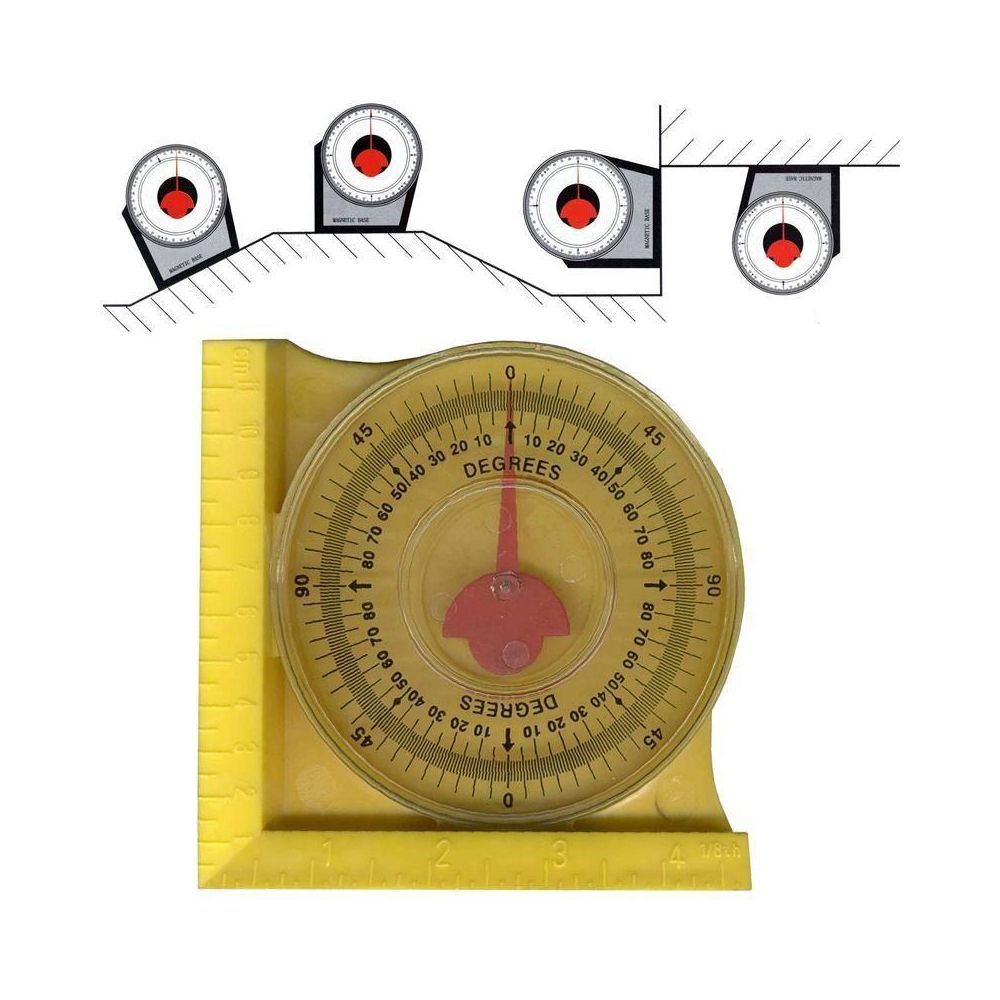

Gain Express Dijital açı ölçer, açı ölçer, eğim ölçer, manyetik V yivli, 0 ~ 360 derece, arkadan aydınlatmalı : Amazon.com.tr: Yapı Market

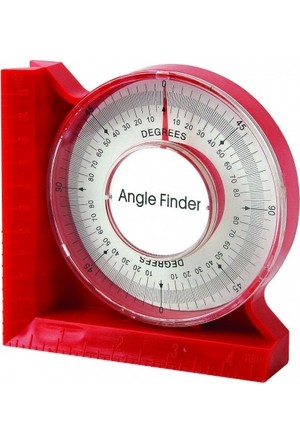

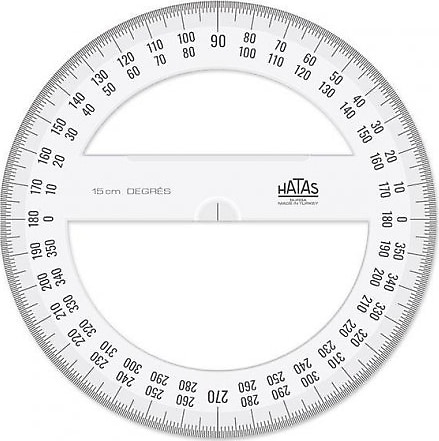

HATAS Plastik Minkale 360 Derece Açıölçer 15 Cm Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

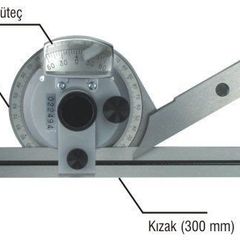

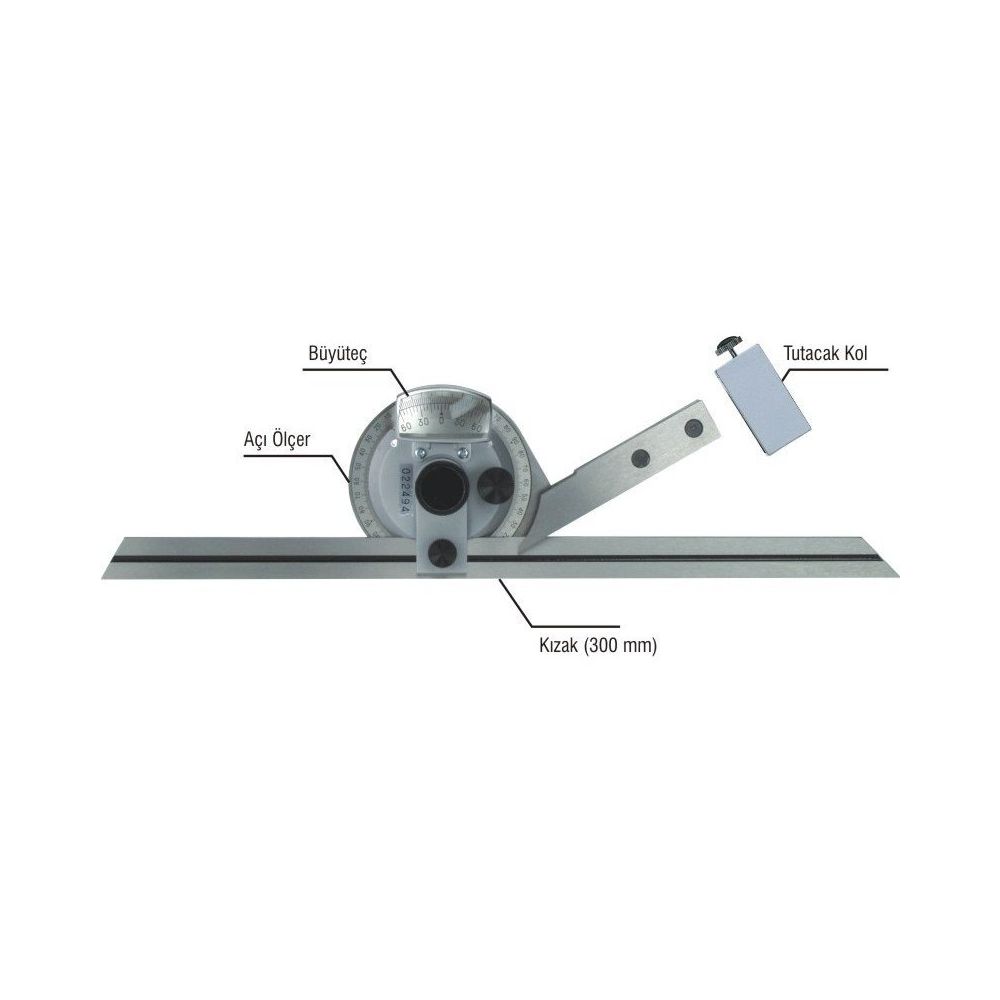

AÇI ÖLÇER İLETKİ, 145 mm. 0-180 Derece Ayarlı GÖNYE Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Elektronik açı ölçer 360 derece iletki dijital goniometre marangozluk araçları açı bulucu çok fonksiyonlu Metal kare cetvel|İletkiler| - AliExpress